Short-term Trading - Bigger Profits Using Multiple Time Frame Momentum Analysis

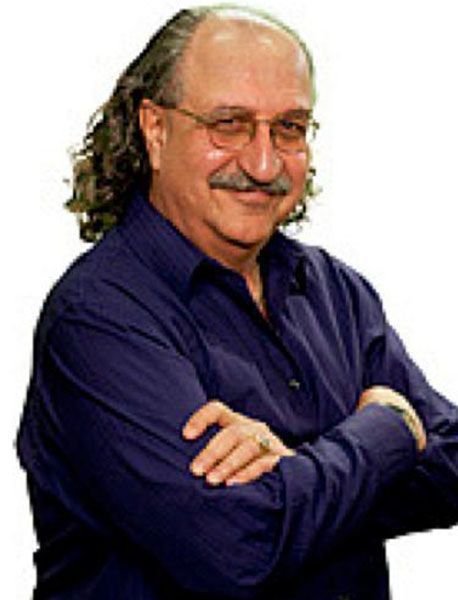

Many short-term traders struggle because they get on the wrong side of the market. Plus, they have more losing trades than winners. And their average win size is smaller than the average losing trades. The cause of that may be psychological or technical. The key is to have a guide that helps the trader stay on the right side of the market much more often, holding for bigger impulses. Then the win/loss ratio is much better, the win size vs loss size is much improved, and the chance of triggering an emotional reaction is reduced. This presentation will focus on the tools to help with directional decisions and chart setups and studies that help stay with the winning trades longer. Plus, Slim will look at some of the biggest challenges for active traders. And, we’ll bring a Wealth365 special, a huge discount on our amazing “DayTrader” app.

Click here to get your free ticket, and join us April7, 2025 from 10:00 AM - 11:00 AM ET.